Hurricane Roof Damage vs. Wear and Tear in Southwest Florida (2026), What Insurance Usually Covers and What It Won’t

After a Southwest Florida hurricane, your roof can look “mostly fine” from the driveway and still be compromised. A few lifted tabs on a shingle roof , a hairline crack on a tile roof , or a pinhole on a flat roof membrane can invite water in fast.

That’s where claim arguments start. Hurricane roof damage insurance is designed for sudden, accidental damage, not a roof that’s simply reached the end of its life. Think of it like a car policy: it helps after a crash, not when the tires wear down.

This guide explains how insurers typically separate hurricane damage from wear and tear in 2026, what proof they often want, and how to protect yourself without creating claim headaches.

How insurers separate hurricane roof damage from normal aging

Adjusters and engineers usually focus on one question: did the storm cause direct physical damage that created a path for water, or did water get in because the roof was already failing?

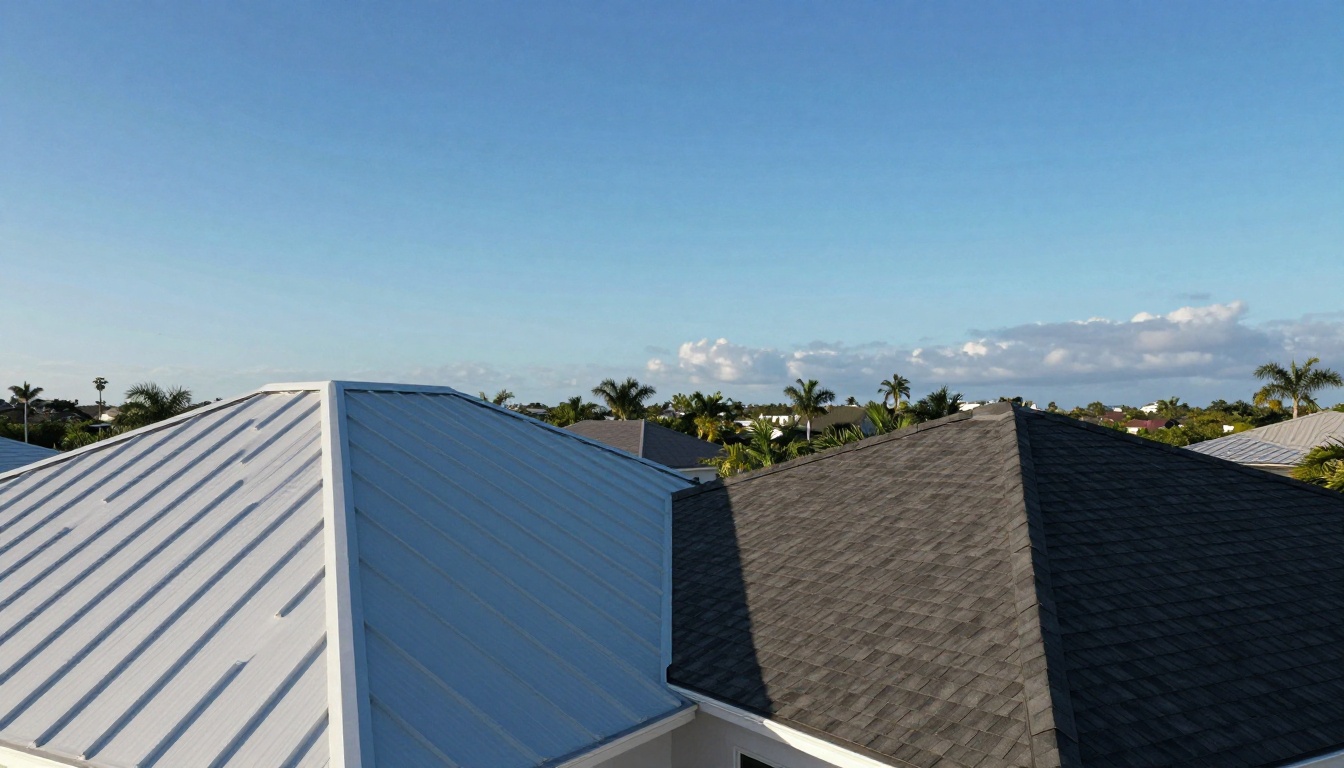

True hurricane damage often has a “before and after” look. Wind can crease shingles, break seals, and pull fasteners, even when only a few areas look disturbed. On a metal roof , wind can loosen clips, lift seams, and bend panels at edges and ridges. On a stone coated steel roof , impact or uplift can damage the coating, expose metal, or disturb flashing details. With concrete or clay tile, a hurricane may break tiles from debris hits, shift tiles, or damage ridge caps and mortar.

Low-slope systems are their own category. A flat roof might show punctures from debris, membrane tears at seams, or flashing failure around curbs and penetrations. For a commercial roof , insurers often look closely at rooftop units, drains, edge metal, and parapet coping, because those details fail first in high wind.

Wear and tear, on the other hand, tends to be widespread and gradual. Common examples include brittle shingles, heavy granule loss, recurring stains that predate the storm, rusted flashing, ongoing ponding water, or long-term underlayment deterioration. If a roof has been leaking for months, a hurricane doesn’t magically turn that into a covered event.

A professional roof inspection after a storm helps document storm-related distress while it’s still fresh. If you’re scheduling one locally, a report from a licensed roofer is often more useful than a quick glance and a guess.

What homeowners insurance usually covers after a hurricane (and when it pays for water damage)

Most Florida homeowners policies generally cover sudden, accidental direct physical loss from wind, and often hail, falling objects, and related damage. In plain terms, if wind damages the roof, the policy may pay to repair that damaged section, and it may also pay for the interior damage that happens because of that roof damage.

The tricky part is water. Many policies cover ensuing water damage only when there’s a storm-created opening or storm-caused damage that lets water in. That’s why insurers may ask for proof of a wind-created opening, not just a ceiling stain.

Typical covered items (policy language varies) often include:

- Wind damage to roofing materials : Missing shingles, lifted metal panels, broken tiles, torn membrane, displaced flashing.

- Interior water damage tied to a covered opening : Wet drywall, damaged insulation, flooring issues, and related repairs.

- Falling debris impact : Tree limbs or airborne objects that puncture the roof surface.

- Reasonable emergency mitigation : Tarping or temporary patches to stop further damage (keep receipts).

Your deductible matters more than most people expect. For named storms, you may have a separate hurricane deductible that is higher than your normal all-other-perils deductible. Citizens breaks this down clearly in its hurricane coverage explainer , and you can also review how deductibles work on the Citizens deductibles page. For a broader state overview, Florida’s CFO has a helpful guide to Florida’s hurricane deductible rules.

What insurance usually won’t cover in 2026 (and the exclusions that surprise homeowners)

Most denials boil down to one theme: the loss wasn’t sudden. Policies commonly exclude wear and tear , deterioration, corrosion, repeated seepage, and maintenance issues. They also often exclude or limit losses tied to faulty installation, defective materials, or poor workmanship. If a leak was “in progress” before the storm, insurers often classify the hurricane as incidental, not causal.

Cosmetic exclusions have also become more common in Florida. Some policies may limit payment for cosmetic damage that doesn’t affect function, such as dents or coating scuffs on a metal roof that don’t create leaks. That can matter after hail or debris, especially on visible slopes facing the street.

Roof age can change the math even when damage is covered. Many carriers apply depreciation more aggressively on older roofs, and some policies include endorsements that pay actual cash value (ACV) for roof surfaces, instead of full replacement cost. ACV can leave a big gap between what you receive and the cost of roof replacement .

Flooding is another common misunderstanding. Storm surge and rising water are not covered by standard homeowners insurance. That’s separate coverage.

For a plain-language overview of what homeowners insurance is designed to cover, see the Florida Office of Insurance Regulation’s homeowners insurance overview. For prevention and discounts, OIR also lists wind mitigation resources , which can pair well with a documented inspection history.

Quick coverage vs. denial examples (typical, not a promise)

| Scenario after a hurricane | Usually covered? | Why it’s approved or denied | What helps your file |

|---|---|---|---|

| Wind removes shingles and rain enters attic | Often yes | Direct wind damage, water follows covered opening | Photos of missing shingles, attic wet spots, roofer report |

| Tile cracks from flying debris impact | Often yes | Sudden impact damage | Photos of impact points, broken tile pieces, storm-date documentation |

| Slow leak that existed before storm, worsens later | Often no | Pre-existing condition, repeated seepage, maintenance | Prior repair records (if any), timeline notes, inspection history |

| Dented metal panels with no leaks (cosmetic only) | Sometimes no | Cosmetic damage exclusion may apply | Documentation of functional impairment (if present) |

| Flat roof seam opens during storm, interior water damage | Often yes | Storm-related membrane failure | Photos of seam separation, moisture mapping, contractor scope |

| Water damage from storm surge | No (homeowners) | Flood is excluded | Separate flood policy claim if you have one |

What to do in the first 72 hours (to protect your home and your claim)

The first few days are about two things: stopping more damage and building a clean timeline. If you need a local professional assessment, start with a documented roof inspection service so conditions are recorded before temporary repairs hide evidence.

First 72 hours checklist:

- Stay safe first : Avoid climbing on wet roofs, watch for downed lines, and keep people out of damaged rooms.

- Photograph everything : Wide shots of each roof slope, close-ups of lifted shingles, displaced tiles, punctures, bent flashing, attic leaks, and any interior staining.

- Prevent more water intrusion : Tarp or temporarily seal active openings, and save all receipts and invoices.

- Start a simple claim folder : Storm date, when leaks began, who you spoke to, and copies of estimates, receipts, and photos.

- Report the claim promptly : Ask what documents they want, and whether your hurricane or named-storm deductible applies.

- Don’t rush into full replacement decisions : Get a written scope first. If replacement is needed, review the local process in this roof replacement guide for Southwest Florida.

- Plan for the next storm : Once the immediate issue is handled, tighten up weak points using this guide on how to prepare your roof for hurricane season in Florida. Business owners should also review commercial roof priorities in commercial roofing services guidance.

Brief disclaimer: This is general information, not legal advice. Your policy wording controls. For claim decisions, consult your policy, your insurer or agent, and a licensed professional (your roofer, adjuster, or other qualified expert).

Conclusion: make the storm date your dividing line

The cleanest hurricane claims usually have one thing in common: they prove what changed on the storm date. If you document early, mitigate responsibly, and get a clear report from a trusted roofing company , you’re in a stronger position to show covered hurricane damage versus ordinary aging.

If your roof is older, or you’re seeing repeated leaks, don’t wait for the next storm to make the decision for you. A thorough roof inspection now can prevent a rushed claim, and it can also clarify whether repair or roof replacement is the smarter move.